The Road to Recovery Post-Pandemic

Uncertainty abounds in the pandemic-riddled lock-down economy. An alphabet soup of recovery possibilities are tossed about by economists and market leaders (see: L, W, U, & V). A rational market should reflect the sum-product of the probability and value of each recovery, but the current state of the macroeconomy is anything but predictable. The nature of the virus will dictate much of the macroeconomic recovery and that has proved to be incredibly hard to predict. However, no matter the larger shape of the recovery, we should expect waves of additional volatility in the short term in both directions.

An L-shaped recovery is characterized by a steep recession that has been realized followed by a slow recovery over several years. Barclays’ sets the probability of an L-shaped recovery at around 10%. The Japanese stagnation from 1991 to 2001 is an example of this type of recovery and is often referred to as the Lost Decade.

A W-shaped recovery also spells trouble, where the economy starts to look better before a second plunge, possibly the result of a surge in cases over the following winter. The early 1980s recession in the U.S. is an oft-cited example of this recovery, The economy fell into recession from January 1980 to July 1980, shrinking at an 8 percent annual rate from April to June 1980. The economy then entered a quick period of growth, and in the first three months of 1981 grew at an 8.4 percent annual rate. However as the Federal Reserve raised interest rates to fight inflation, the economy dipped back into recession from July 1981 to November 1982. Following the double-dip, the economy then entered a period of mostly robust growth for the rest of the decade.

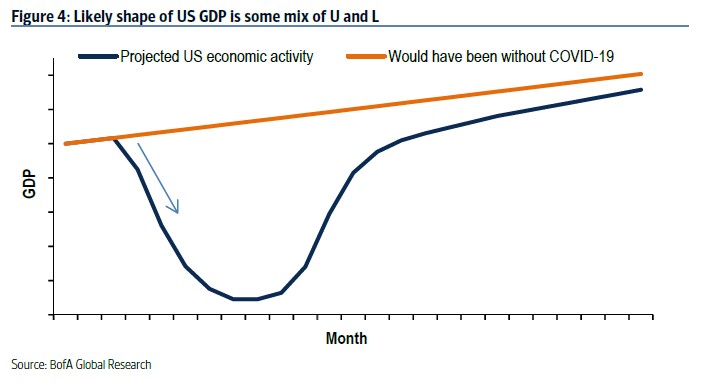

A U-shaped recovery may be the most likely. Of the U.S. recessions since 1945, around have been described to have a u-shape. Theotrade, an investing education platform has predicted a mix between an L and U-shaped recoveries, shown below.

Lastly, a V-shaped recovery is the most hopeful, characterized by a quick and sustained recovery. Both Apple CEO Tim Cook and the St. Louis Federal Reserve President James Bullard have predicted this type of strong recovery.

The CARES Act and future stimulus packages come to offer hope for every-day consumers, small businesses, and even large firms looking for a bailout. Additional positive shocks may come from earning reports coming in better than expected or peaking daily case counts. Many others retain hope of re-opening the economy, click HERE for a breakdown of where all 50 states stand on reopening. With reopening comes additional uncertainty. As states experiment with a variety of re-opening strategies, each strategy’s viability will be tested and allow us to update the set of probabilities for a nationwide return and reassess the expected value of the macro-economy.

The shape of the return is still in question and will be continuously tested over the next several months. There is no doubt a return is coming, but there is little doubt that we will hit some bumps along the way.

Great post! Very high-quality! Keep it up! 🙂